Zo is de premie opgebouwd

Elk jaar bepalen we de premie van de zorgverzekering. Dat is best ingewikkeld, maar we leggen het u graag uit. Leest u mee hoe wij dit doen?

Als inwoner van Nederland heeft u verplicht een basisverzekering. Hiervoor betaalt u premie. Het ministerie van Volksgezondheid, Welzijn en Sport (VWS) bepaalt de inhoud van de basisverzekering. En dus wat u vergoed krijgt. De basisverzekering is voor iedereen hetzelfde. Maar de hoogte van de premie verschilt per zorgverzekeraar.

Hoe komt de premie voor de basisverzekering tot stand?

De overheid bepaalt een deel

Wij bepalen zelf een deel

Elk jaar stellen wij de premie vast

Om de premie te bepalen, maken we elk jaar een inschatting van de zorgkosten voor onze verzekerden. Net als de overheid maken wij óók een schatting van de zorgkosten die we het komende jaar verwachten. En we kijken naar de kosten van bijvoorbeeld onze klantenservice én naar onze reserves. We zijn namelijk wettelijk verplicht om geld op de plank te hebben. Dit is bedoeld om zorgkosten te betalen als er plotseling extra veel kosten zijn, bijvoorbeeld bij een ziekte die in grotere aantallen dan normaal voorkomt (een epidemie ). Omdat de zorgkosten ieder jaar stijgen, moeten we ook ieder jaar meer reserves hebben. We maken dus steeds een inschatting van de kosten. Achteraf blijkt of die kosten hoger of lager waren dan we dachten. Dan hebben we een positief of negatief resultaat. Een positief resultaat gebruiken we om uw premie minder te laten stijgen of het gaat naar de reserves óf we investeren ermee in zorg. Een negatief resultaat betalen we uit de reserves.

Van welk jaar wilt u de premie zien?

| Omschrijving | Bedrag | ||

|---|---|---|---|

| Omschrijving | Rekenpremie | Bedrag | € 1.708 |

| Omschrijving | Bedrag | ||

|---|---|---|---|

| Omschrijving | Resultaat op zorgactiviteiten: het verschil tussen het bedrag dat we aan premie en uit het Zorgverzekeringsfonds ontvangen en dat we aan zorgkosten uitgeven. | Bedrag | - € 28 |

| Omschrijving | Bedrijfskosten: de kosten van ons bedrijf om ervoor te zorgen dat u een zorgverzekering kunt hebben. Zoals kosten voor onze klantenservice, IT en werkplekken van medewerkers. Natuurlijk proberen we deze kosten zo laag mogelijk te houden. | Bedrag | € 65 |

| Omschrijving | Inzet verwachte beleggingsopbrengsten: de opbrengst van onze beleggingen welke wij inzetten voor de premie. | Bedrag | - |

| Omschrijving | Onttrekken van reserves: het geld dat we vanuit onze reserves inzetten om de premie minder te laten stijgen. | Bedrag | - € 9 |

| Omschrijving | Toevoeging aan reserves: soms is toevoeging aan onze reserves nodig. Zo voldoen we aan de verplichting van de overheid om voldoende geld op de plank te hebben om zorgkosten te betalen als er plotseling extra veel kosten zijn. Bijvoorbeeld bij een epidemie. Als de reserves voldoende zijn, hoeven we geen geld toe te voegen. |

Bedrag | - |

| Omschrijving | Opslag winst | Bedrag | - |

| Omschrijving | Opslag korting vrijwillig eigen risico: u krijgt korting op uw premie als u naast het verplicht eigen risico ook kiest voor een vrijwillig eigen risico. We houden hier rekening mee in het bepalen van de premie. |

Bedrag | € 15 |

| Omschrijving | Oninbare premie: we moeten rekening houden met verzekerden die hun premie of zorgkosten niet betalen. |

Bedrag | € 6 |

| Omschrijving | Overige opslag | Bedrag | € 9 |

| Omschrijving | Belasting | Bedrag | - |

| Omschrijving | Gemiddelde premie Zilveren Kruis* (totaal) | Bedrag | € 1.766 |

| Omschrijving | Gemiddelde per maand | Bedrag | € 147,17 |

| Omschrijving | Bedrag | ||

|---|---|---|---|

| Omschrijving | Rekenpremie | Bedrag | € 1.599 |

| Omschrijving | Bedrag | ||

|---|---|---|---|

| Omschrijving | Resultaat op zorgactiviteiten: het verschil tussen het bedrag dat we aan premie en uit het Zorgverzekeringsfonds ontvangen en dat we aan zorgkosten uitgeven. | Bedrag | - € 14 |

| Omschrijving | Bedrijfskosten: de kosten van ons bedrijf om ervoor te zorgen dat u een zorgverzekering kunt hebben. Zoals kosten voor onze klantenservice, IT en werkplekken van medewerkers. Natuurlijk proberen we deze kosten zo laag mogelijk te houden. | Bedrag | € 57 |

| Omschrijving | Inzet verwachte beleggingsopbrengsten: de opbrengst van onze beleggingen. | Bedrag | - € 4 |

| Omschrijving | Onttrekken van reserves: het geld dat we vanuit onze reserves inzetten om de premie minder te laten stijgen. | Bedrag | - € 15 |

| Omschrijving | Toevoeging aan reserves: soms is toevoeging aan onze reserves nodig. Zo voldoen we aan de verplichting van de overheid om voldoende geld op de plank te hebben om zorgkosten te betalen als er plotseling extra veel kosten zijn. Bijvoorbeeld bij een epidemie. Als de reserves voldoende zijn, hoeven we geen geld toe te voegen. |

Bedrag | - |

| Omschrijving | Opslag korting vrijwillig eigen risico: u krijgt korting op uw premie als u naast het verplicht eigen risico ook kiest voor een vrijwillig eigen risico. We houden hier rekening mee in het bepalen van de premie. |

Bedrag | € 17 |

| Omschrijving | Oninbare premie: we moeten rekening houden met verzekerden die hun premie of zorgkosten niet betalen. |

Bedrag | € 8 |

| Omschrijving | Overige opslag | Bedrag | € 2 |

| Omschrijving | Belasting | Bedrag | - |

| Omschrijving | Gemiddelde premie Zilveren Kruis* (totaal) | Bedrag | € 1.650 |

| Omschrijving | Gemiddelde per maand | Bedrag | € 137,50 |

Van de zorgpremie betalen we natuurlijk allereerst de zorg

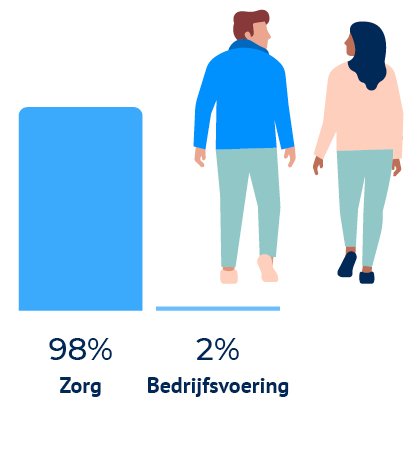

Van elke euro die onze verzekerden aan premie betalen gaat € 0,98 naar zorg. Zoals de huisarts, medicijnen die u gebruikt of een operatie in het ziekenhuis. € 0,02 gaat naar onze bedrijfsvoering. Zoals kosten voor IT, onze klantenservice en werkplekken van medewerkers.

Welke zorg wordt van uw premiegeld betaald?

98% van het premiegeld voor de basisverzekering gaat naar zorg. Zo gaat bijvoorbeeld 54% naar ziekenhuiszorg.

*= Onder andere logopedie, diëtiek en fysiotherapie

.jpg?rev=1C1854FBA881427BB950811DBDDCD0A8&auto=format%2Ccompress&fit=crop&hash=8DC8C1D4A268EE5B312BEDC47B635B9F)